Voice Out-of People: The new FHLBanks try a professional lover so you’re able to quicker creditors

Dec 31, 2024By the undertaking our key reason for delivering players which have exchangeability support everyday of the history 90 age as well as because a shock absorber in times from crises i underpin balance in the us financial system.

As a result of all of our access to your debt segments, the latest FHLBanks can certainly meet the liquidity and you may investment requires out of our very own professionals. This permits our users to help you give with certainty, once you understand he has got a way to obtain credible liquidity if the you would like comes up. Top rating enterprises such as for instance Moody’s acknowledge the latest unique role’ FHLBanks gamble inside taking liquidity into economic climate, most recently shown in the Q1 2020 during COVID markets stress.

The fresh new FHLBanks was in fact designed to end up being vibrant through the notice-capitalizing nature off member progress pastime, increasing and you will employing once the needs away from associate creditors and you can their teams change-over day. So it scalability are to the display in 2018-2021 period, where enhances began fluctuated by around 250% in response to altering demands.

From inside the International Economic crisis, from Q2 2007 so you’re able to Q4 2008, enhances a good increased from the $258B (40%), permitting support of several faster creditors. The fresh FHLBanks was indeed the biggest source of crisis-related exchangeability on the economic climate up until the Federal Put aside intervened into the .

In early grade of your COVID-19 pandemic, ahead of Government Set aside and legislative intervention, advances a fantastic rapidly enhanced by $158B (25%) from inside the Q1 2020, more and this occurred in the previous few months of . This proves the new basic responder status we hold in the market, helping carry out balances and you can cover .

An upswing Program try a huge help all of our bank since we worked twenty-four hours a day to keep paychecks in the possession of away from experts regarding the organizations we suffice. Thanks FHLB Cincinnati getting helping us let anybody else.

The FHLBanks and additionally assistance its communities when regional crises hit. Like, we are able to promote energetic and you will tailored service in case there is sheer catastrophes, instance hurricanes, storms, and you may wildfires.

Case study

We were in a position to help the majority of people towards financial support that Government Mortgage Financial create. We would not be in which our company is today because a residential district instead the help from FHLB Dallas and therefore a great many other anyone and you can communities just who unsealed the hearts and you can purses to assist.

The local construction including supporting reduced, area loan providers who become minimal inside their power to suffice their organizations without FHLBanks.

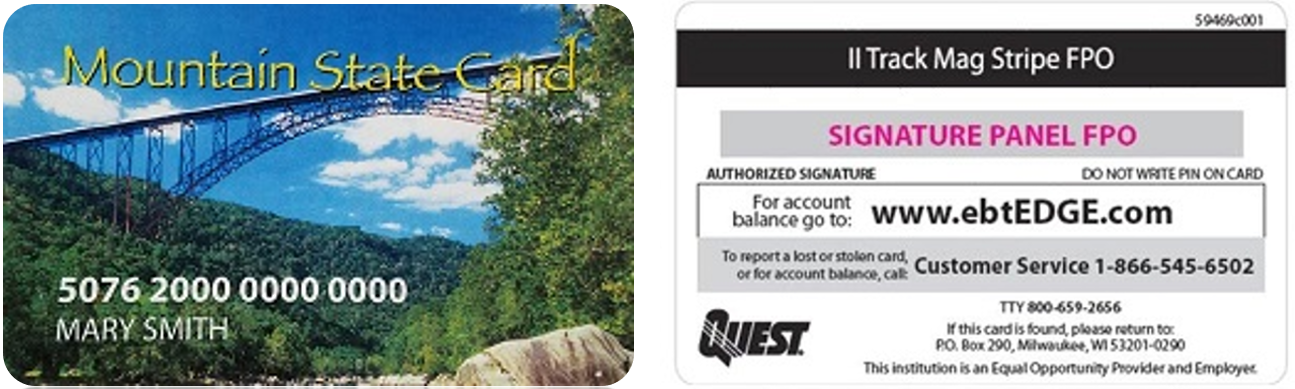

60% try Neighborhood Loan providers which have assets less than $1.323B, getting just who this new FHLBanks play the role of a switch pillar out-of economic service. This in turn allows our people to add the teams that have enhanced the means to access borrowing from the bank and you can construction. These types of faster players are creditors offering outlying organizations or other underserved organizations.

All of our quicker people consistently focus on the new critical character the fresh new FHLBanks play in enabling them to stay aggressive and supply credit on the users.

In a situation off disturbance, getting the Lender once the a robust lover is also a lot more essential. We’re speaing frankly about very high liquidity facts, and you may FHLBank San francisco bay area advances are very important so you can money for the an enthusiastic interim basis a completely needed step.

Improves is actually a part of the wholesale money means. It help us satisfy each other small- and you may a lot of time-identity liquidity needs. For a long time, our bank has turned to FHLBank Boston having capital because they is a reputable spouse and gives easy performance.

[FHLB Nyc] addressed our very own very small credit connection($fifteen million from inside the property) and you can all of our Board out-of Administrators exactly the same way while they cure every other standard bank. It actually was a beneficial feel and then we are particularly thankful.