Exactly how Are Ginnie Mae, Va money, and IRRRL Related?

Dec 17, 2024There is a large number of unusual labels you to definitely pop-up for the discussions regarding the mortgage brokers together with home loan https://paydayloansconnecticut.com/noroton-heights/ business. Have you ever pondered who Ginnie Mae are and you may just what she’s got related to mortgage brokers. Freddie Mac computer otherwise Fannie mae also are brought up frequently. Will they be regarding Ginnie Mae? Then there is Irle. He or she is pretty prominent. He audio British, best? Such names was common to help you home loan masters, but usually mean nothing to your mediocre user. Ginnie Mae, Irle, Freddie Mac computer, and you can Fannie mae is actually a great family in a way. All of them are acronyms associated with additional home mortgage organizations and you can programs:

- Ginnie Mae ‘s the Bodies National Financial Relationship (GNMA)

- Federal national mortgage association ‘s the Federal national mortgage association (FNMA)

- Freddie Mac computer was Government Financial Home loan Company (FHLMC)

- Irle ‘s the Rate of interest Protection Refinance mortgage (IRRRL)

Ginnie Mae falls inside the Company out of Houses and you may Metropolitan Development (HUD). Its origins wade dating back to the favorable Depression, plus it can be acquired to advertise owning a home. Ginnie Mae ‘s the primary investment sleeve to have authorities financing. Va financing are a variety of bodies loan and tend to be guaranteed of the U.S Company regarding Pros Factors (VA). A keen IRRRL is an alternative Va refinance mortgage.

Va Mortgage System

This new pri should be to let eligible veterans finance the purchase out of house that have favorable financing terms and conditions and at aggressive rates. The definition of veteran includes productive obligations Servicemembers, Veterans, Reservists, National Guard participants, and you will particular thriving spouses.

A cash-Out Refinance mortgage are often used to pay financial obligation, funds college, build renovations, otherwise re-finance a low-Va home loan for the an effective Virtual assistant home loan. Pros also have usage of a keen IRRRL, a streamlined refinance system.

Individuals try not to get in touch with Ginnie Mae or even the Va if they are interested in a good Virtual assistant mortgage. Like other lenders, he’s complete courtesy personal loan providers, instance banks and you will home loan companies.

Benefits associated with Va Mortgages

- Down interest rates

- No advance payment

- No home loan insurance

- Down fico scores

- Closing cost limitations

1. Lower Rates of interest

Brand new Va guarantees a portion of for every Va loan, and this be sure assists include the lender from loss in the event your debtor doesn’t pay back the borrowed funds. Since Virtual assistant financing offer shorter risk than other variety of home loan money, lenders are safe giving a reduced interest rate. A diminished interest can benefit a debtor inside software techniques by permitting them to be eligible for a larger loan amount. It may also make the borrower expenses less inside notice across the lifetime of the loan.

dos. No Down-payment

A Va financing has no need for a downpayment so long as the new marketing rate cannot meet or exceed the latest appraised property value the home. Having said that, other mortgage apps require a down-payment away from from around step three.5 % in order to 20%. Having the ability to financing 100 % of purchase price you are going to succeed a debtor purchasing a home sooner when compared to many other financing apps.

step three. No Mortgage Insurance policies

Borrowers are typically expected to buy financial insurance when they try not to generate a 20% advance payment. That it insurance plan compensates the lender or buyer when your borrower will not result in the home loan repayments as well as the mortgage gets into standard. Although not, given that an effective Va financing are guaranteed, home loan insurance is not required and results in an economy for the borrower.

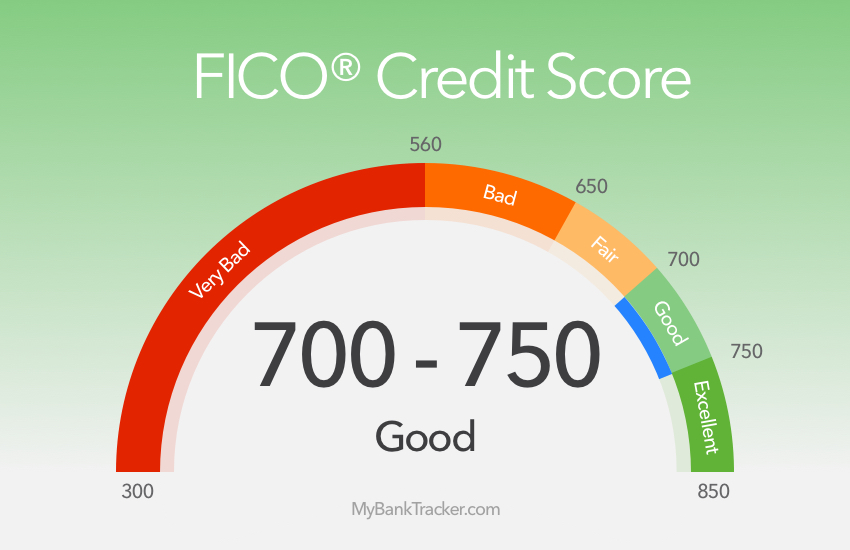

4. Down Credit scores

Credit ratings is an integral part of being qualified for house mortgage. A debtor that have a lesser credit history is recognized as being increased chance than simply a borrower having a higher credit history. Brand new Va will not place credit history minimums getting Virtual assistant money. The fresh new minimums will vary with respect to the lender. However, due to the fact a great Virtual assistant mortgage are protected, the fresh new borrower can expect far more flexibility together with result is commonly a lower life expectancy credit history minimal than what would be acknowledged to own other types of financing.